I wanted to call this entry “Y Combinator Is A Bullshit Idea” but the ads on the side wouldn’t have displayed due to the “bullshit” in the title.

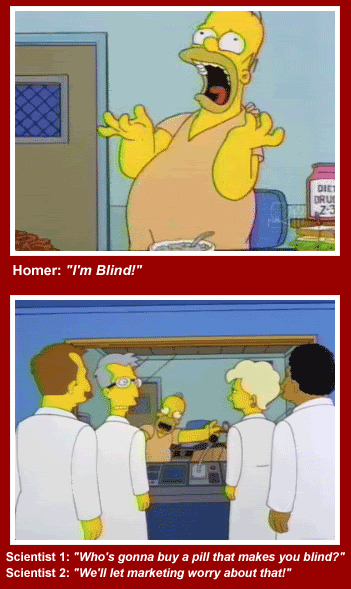

So, I just read the Christopher Steiner article “The Disruptor In The Valley” at Forbes.com (which is about Paul Graham and his company Y Combinator) and I immediately thought of the bit from “The Simpsons” (Season 12 – Episode 9) when Homer is undergoing medical experiments for money. He tries an appetite suppressant:

HOMER: “I’m BLIND!”

HOMER: “I’m BLIND!”

SCIENTIST #1: “Who’s gonna buy a pill that makes you blind?”

SCIENTIST #2: “We’ll let marketing worry about that!”

Y Combinator is basically offering Silicon Valley a pill that makes them blind (but marketing will fix it).

They offer a little bit cash to grab a whole lot of equity in these tiny start-ups – most which are not even close to being ready for that kind of exposure (or financial decision).

However, with the right spin, PR and influence behind them, they (apparently) ARE ready for the additional money that others might throw their way (for another giant chunk of equity)… IF they can manage to get through the grueling YC BOOTCAMP.

So many of these companies just aren’t ready and, frankly, just aren’t necessary.

It’s like the YouTube star who gets a small role on “The Big Bang Theory” and can barely speak because they’re so nervous and everyone realizes they have no acting skills whatsoever.

This is not to say that there aren’t a lot of geniuses out there with a lot of great ideas. There are. Most are much smarter than me (but not as smart as Khan Manka, Jr. – I’m under order to say).

But these geniuses (and mostly non-geniuses, let’s be serious) are being exploited by Paul Graham and company and tossed to these VC wolves who will eat many a carcass to get to the next Facebook (which MUST BE STOPPED… but I digress).

Seriously, in another Hollywood analogy, any start-up attempting to get their business going through Y Combinator is like the screenwriter in Los Angeles who will pay people to read their script because they “work at a studio.”

The chances of success in one of these cattle call models is virtually zero.

Zero for everyone except Paul Graham (and partners).

As a quick primer, allow me a paragraph (from Wikipedia) to explain Y Combinator to those who may not know what it is:

Y Combinator is an American seed-stage startup funding firm, started in 2005 by Paul Graham, Robert Morris, Trevor Blackwell, and Jessica Livingston. Y Combinator provides seed money, advice, and connections at 3-month programs. In exchange, they take an average of about 6% of the company’s equity.

Compared to other startup funds, Y Combinator provides very little money ($17,000 for startups with two founders and $20,000 for those of three or more). This reflects Graham’s theory that between free software, dynamic languages, the web, and Moore’s Law, the cost of founding a startup has greatly decreased.

In other words, throw a bunch of shit on the wall and see what sticks.

In other words, throw a bunch of shit on the wall and see what sticks.

Great for Paul Graham (based on his idea, Y Combinator would have gotten $20,000 from Y Combinator), but terrible for almost all of those thousands who apply to his program every year just in the hope of getting the YC stamp of approval (and 60 lbs of chili).

So Y Combinator is a Venture Capitalist that funds your start-up so that your start-up can get funded by another Venture Capitalist.

Enough with these f-ing VCs, man.

Whatever happened to creating a company, becoming successful and growing it based on that initial success?

Success because you have a product that people really (REALLY) want.

Thousands of techies are just sitting around coffee shops and cafes in all the “Silicon Valleys of the world” trying to think up new ideas that Paul Graham (and others like him) might like.

Not because it’s an idea that the start-up founder actually believes in anymore – but because it’s one that might get funding.

I mean, fuck passion, right?

These days it’s not whether your company succeeds or fails, it’s whether it gets funded in the first place and a mention on TechCrunch.

Jill Kennedy – OnMedea

Jill Kennedy – OnMedea

P.S. – Also Digg is dead – R.I.P. – so is Electus and Comic-Con… but I digress… again.

So, this site is sort of like The Onion for entertainment except really poorly written and devoid of humor?

Poorly written like a fox!

I enjoyed it, a lot of good points – especially YC funding themselves, lol. We need more sarcastic commentary to balance the next impending .com bubble and tech hype

+1

If Y Combinator funded incubators, then maybe they would accept Y Combinator. Don’t see what is funny about that.

You also completely ignore anything YC might do besides give out cash and take equity.

Also, companies not ready for “the exposure” of YC… don’t announce themselves and just do YC. You really aren’t familiar with your topic are you? Most YC companies stay in stealth until afterwards.

Appalsap, you know you’re absolutely wrong in this. Sure, Y Combinator and the great Paul Graham may actually give out some great advice like – ‘Make your idea more mainstream’ – ‘Create a product that people might actually use’. These are ingenious tidbits that only a management guru such as PG could come up with. Here’s another one that I just thought of – if you create the next big thing, I will be willing to invest $17,000 for 8% of your company. Deal? Awesome! Fuck yeah! I’m rich!

I think the point of this article is more about how the do-it-yourself, authentic “entrepreneur” philosophy is no longer strong among tech startups. In the modern tech startup world, it’s now all about dependence on VCs and TechCrunch and Y Combinator. It’s not the “done thing” to make a company from scratch anymore.

Maybe an idea of making a company from scratch is just a dream. Networking is always involved – now it’s just formalised.

Hmmm.

I’m surprised anyone can do anything for $17,000.

You can get the new Jetta for $17,000 – or fund a billion dollar start-up!

I guess grossly overpaying for an Ivy League MBA then working at a failed bank will inspire this type of anger/negativity. Especially towards people who probably paid far less for their education and who are making money (or not) doing something they enjoy.

You’re like the Ann Coulter of the tech world. Perfect…

Imagine getting establishing a fund and getting equity in every freakin’ company that’s out there. It’s like the TV business – all it takes is one. The losers are the writers who make the show that gets on 2 episodes on the air – and that’s most people.

I could not agree with you more Jill. Y combinatory is really a tech version of ABC’s SharkTank: Someone enters with a million dollar business, gets 50,000 for 51% of the company.

The worst part of this is that once you have been part of the program you are apparently golden and anything you do will be the next big thing. For an example of that take a look at AngelList and see some of the stupid idea’s that get funded there just because of the “right” connection.

Long live the old boys club. It will never die!

Thanks for your comment, snow. It’s a tough argument to make when there are so many eager people in Silicon Valley to make the quick bucks. There is just no talking to them.

Paul Graham is doing something called “Office Hours” at Tech Crunch disrupt.

http://techcrunch.com/2011/05/17/paul-graham-to-hold-y-combinator-office-hours-at-techcrunch-disrupt-apply-now/

HA!

http://www.wired.com/magazine/2011/05/ff_ycombinator/

This article couldn’t be less informed or ridiculous. Out of hundreds of companies funded by YC, ours included, you would be hard pressed to find even half a dozen people who say they didn’t think the equity they gave up was worth it, and these include the AirBNB’s, Dropbox’s and Heroku’s of the world. Many companies had proven teams and revenue headed into the program, debunking your theory that they’re too uninformed to make smart financial decisions, and they still claim that it completely changed the trajectory of their business.

You’re also forgetting that most of the companies who walk in have barely an idea and a prototype. Most investors won’t invest until you have traction, won’t do more than spend a few minutes on the phone every month, and won’t take a meeting without an introduction. Paul Graham and YC take meetings with anybody who seems promising on paper, invest in people instead of traction, and then help those people get on the right path before introducing them to hundreds of the highest quality contacts a web company could hope to mingle with.

People give up .5-2% of their company just to get a high value-add advisor on their team. Giving up 6% for $20k, a 300-company network of all-stars and the opportunity to pitch the best VCs in the valley is a no-brainer – which makes it surprising that you didn’t pick up on the value.

Of course that’s how you feel. That’s how almost everyone feels when they think they’re going to have the next big thing. Seriously, it’s just such an isolated world in which everyone believes everything they have is something everyone must have. Granted, you have to believe in your ideas and truly think that yours is something that will “conquer the world” but it’s really just a crap shoot and companies like Y Combinator, no matter how well regarded, can’t spin shit into gold.

In Hollywood, it’s great to have a top agent, you can get a lot of meetings, but if you can’t write or act or direct, you won’t succeed. Paul Graham is going to represent everyone who is somewhat competent, take his cut and hope for the best. All those who can’t write, act or direct or going to be left behind. Which is the way it should be – but, seriously, Y Combinator isn’t necessary – if anything, it gives something (or someone) legitimacy when it isn’t deserved.

And, if a follow up question is, ‘why do you care’? The answer is, I’m not really sure but something about this whole industry of incubators bothers me. Something is not right. It just doesn’t seem healthy for the overall develop and growth of the sector.

I know why you care. You care because people read articles about YC. Why? Because as much as you’d like to ignore it, some bad ass companies are coming out of there.

In our batch alone, one has already been acquired by Google, one has raised $4.5 million from Sequoia (based on a ton of revenue), and others have massive traction or revenue. That’s not a crap shoot. Most investors don’t get that kind of result, and those are investors who pick companies much further along and give them even more financial resources. YC picks companies that have almost nothing built coming in, and these are the results coming out.

You really have no idea what you’re talking about.

If you think people read stories about Y Combinator then you really don’t know what you’re talking about.

So endgame is getting bought by a bigger company? Endgame is making money? Where’s the love, Joey? I’m sure these badass companies don’t just sit around and think of ideas that will make money. I’m sure these badass companies think of ideas that excite them. Things that they want (and hope others do, too).

I’m sorry, but “integrity” is just not a word I think of when I think of the VC world of Silicon Valley. If you have a project you are passionate about, these people will suck it dry and leave a mindless shell (with a couple million bucks). And, yes, for a lot of people that is endgame.

Let’s see how many senior executives remain at LinkedIn in a few months after they can cash out. My guess, they’ve got what they were after – it’s not really about the product at all.

You’re living in a black and white world. Some dreams take money to make happen. The people who give you that money need to make it back. That doesn’t happen without an exit. The people at LinkedIn have been working hard for almost a decade and have completely changed the landscape of how people network online. Their hard work is paying off; they deserve it. Countless people are employed because of LinkedIn. So what if some of the people who made that happen are ready to move on.

I find a comment about integrity to be a little difficult to stomach from a hardened cynic fresh out of Lehman Brothers.

P.S. I found you because of your comment on Wired’s YC story. Are you one of the people who doesn’t read stories about YC?

Joey, if you can’t bootstrap your company for 20k then, you are really not ready to be an entrepreneur. Furthermore if you are willing to give away 6% of your company for 20k you are not a businessman, and should hire someone to manage your business ASAP. I truly believe that YC is a tech version of SharkTank and its sole purpose is to get desperate people to sign away their company for pennies on the dollar.

Agreed. Paul Graham, who seems to be everywhere now (he looks like he loves the media attention), mentioned that Y Combinator has invested around $5 million and the companies invested in are worth (on paper… flimsy flimsy paper) $3 billion. Does that mean Y Combinator’s (on paper) value in these companies is around $300 million? Nice work if you can get it.

Jill, As I mentioned above, it doesn’t matter what crap you did at YC, as soon as you mention it you have investors flocking to you as flies on a turd.

Joey elaborate on this elsewhere, but when these guys only got an idea and nothing else, it basically means that YC gives them 20k based on their word. I fail to see how that validates them as serious entrepreneurs in any shape or form.

Silicon Valley has a follow mentality which is highly illustrated through YC. Nothing new or innovative will come out of this era as long as that is the case. I am really looking forward to that 125th clone of twitter/facebook/place-your-own-app-here!

“I am really looking forward to that 125th clone of twitter/facebook/place-your-own-app-here!”

I’m with you – because every new one that comes along is SO MUCH BETTER!

I don’t get it, do you have any real arguments why Y Combinator is bad? Or are you limited to slinging ad hominems at people who choose to do business in a way that doesn’t conform to your personal (and unrealistic) memories of the “good ol’ days” of entrepreneurship?

Times change, suck it up.

Jill – As a tech entrepreneur in NYC with no interest in entering the Y Combinator program and differing perspectives than many West Coast entrepreneurs and investors, the value of Y Combinator is tremendous.

Paul Graham is saying that he can house and feed smart people for up $20k maximum while they develop products that he has an interest in. YC can then get those products funded and help generate traction via press and partnerships. It’s a fantastic model and gives the entrepreneur an invaluable network for life. What you fail to realize is that many entrepreneurs are serial entrepreneurs, they give up 6% for guaranteed funding and a ridiculous network in only their first company, not 6% of everything they ever do, which I guarantee will only be positively influenced by their participation in YC.

See, CEO of a financially backed tech-startup, it’s not that I’m against anyone with a great idea getting a little money and developing their idea – it’s just… I really don’t think Paul Graham is that interested in these ideas. There might be some where his brain goes ‘ding ding ding – I can see this making money’. And that’s not necessarily a bad thing. But I watched the video of him at the TechCrunch disruptor and he really wasn’t that interested in these new ideas – personally. He wasn’t that passionate and, I can imagine, really wouldn’t use any of these new technologies.

Too many people are developing too many things that we don’t need. Not enough disrupt and too much ‘bolt on’. And what’s the value of ‘bolt on’ when the innovators can develop that stuff themselves.

We are now moving towards a different argument, which is fine. How many lawyers, accountants, consultants, asset managers, and I-bankers do you know that neither love their work or care about the companies or people that they are working for? It is a living, and I know plenty that absolutely hate their jobs. Why should software engineers have to necessarily love what they are building? Life is about seeing opportunities an taking them. One can appreciate taking risk for a major payday without being in love with what that opportunity is.

As for Graham, he can enjoy molding and propelling entrepreneurs (who are the backbone of the US economy) without thinking that what they are building is status-quo changing and at the same time create a business out of it.

I think Paul Graham loves Y Combinator and loves what he’s doing – I just don’t think he cares about the companies he is mentoring (with the exception of how much he can jack up the value). And, yes, this is a great thing for all those involved financially – I just don’t be the financials. Yes, entrepreneurs are the backbone of the economy – but this backbone has been through a lot over the last couple of years and we just don’t want the thing to break again. It’s all so inflated and really just Monopoly money at this point.

Do you really believe all this is sustainable? All these companies, many dropping out of college and quitting jobs, to slave away for a guy who, I don’t feel, is really on the level.

@CEO, I find it very humorous that you bring up serial entrepreneurs. Most of these entrepreneurs’ first startups are clones or remakes of existing ideas, but with much more hype. Airbrn and DropBox are not new concepts and they are definitely NOT worth 1+ billion. That value is only there because of the hype that Y-Combinator manages to build around them. The entrepreneurs are lead through the process as blind mice with little actual knowledge required to get to the end.

Once they have become “successful” they are golden boys that can’t do anything wrong. Any venture they start will be swarmed with Angels and VC’s like flies around a month old hamburger. The problem is that they are trying to convince us all that we should pay a premium for that old hamburger or maybe something similar stupid as bottled air from the mountains. The “serial” in them is only there because of over eager Angels/VC’s with a follow mentality.

The best thing Paul Graham could do, would be to ban any reinvesting in YC alumni. Obviously that is literally impossible, but it would be nice if any YC “student” had to sign an agreement that prohibits them from EVER starting/joining/advising a startup again. This would force these same eager Angels and VC to actually take a look at real entrepreneurs and give them a chance to create something worthwhile instead of another Twitter/Facebook/name-your-own clone

Thanks snow. You’ve got my back on this one. There are a few people out there sounding the alarm (which, to be serious, is not that big of deal in the scheme things) on Y Combinator but not many. Lots of kool aid drinking going on in Silicon Valley.

So, again, Snow, you are telling me a company who has grown (in terms of usership 50+% in the first four months of 2011 and generated 100 million dollars in revenue in 2010 is not worth one billion dollars? And Jill, you agree with him? What Ivy League School gave you an MBA? Remind me to never send my child there…

I do agree with Snow. You are making huge assumptions to get to that valuation. The conversion from freemium to premium is the most difficult thing any business will do. Facebook will probably have to do it at some point and it could very well kill the company.

And I went to Columbia – and yes, please, don’t send you child there.

So, what you’re saying is that Dropbox could not have been successful without YC? I guess that makes it worth it then…

It seems to me that Paul Graham is much more interested in the valuation of these companies than he is the actual products they produce.