I wanted to call this entry “Y Combinator Is A Bullshit Idea” but the ads on the side wouldn’t have displayed due to the “bullshit” in the title.

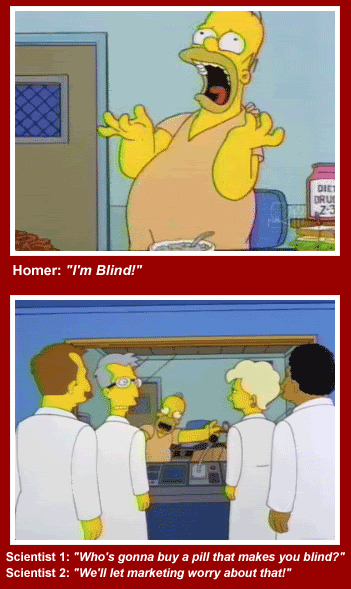

So, I just read the Christopher Steiner article “The Disruptor In The Valley” at Forbes.com (which is about Paul Graham and his company Y Combinator) and I immediately thought of the bit from “The Simpsons” (Season 12 – Episode 9) when Homer is undergoing medical experiments for money. He tries an appetite suppressant:

HOMER: “I’m BLIND!”

HOMER: “I’m BLIND!”

SCIENTIST #1: “Who’s gonna buy a pill that makes you blind?”

SCIENTIST #2: “We’ll let marketing worry about that!”

Y Combinator is basically offering Silicon Valley a pill that makes them blind (but marketing will fix it).

They offer a little bit cash to grab a whole lot of equity in these tiny start-ups – most which are not even close to being ready for that kind of exposure (or financial decision).

However, with the right spin, PR and influence behind them, they (apparently) ARE ready for the additional money that others might throw their way (for another giant chunk of equity)… IF they can manage to get through the grueling YC BOOTCAMP.

So many of these companies just aren’t ready and, frankly, just aren’t necessary.

It’s like the YouTube star who gets a small role on “The Big Bang Theory” and can barely speak because they’re so nervous and everyone realizes they have no acting skills whatsoever.

This is not to say that there aren’t a lot of geniuses out there with a lot of great ideas. There are. Most are much smarter than me (but not as smart as Khan Manka, Jr. – I’m under order to say).

But these geniuses (and mostly non-geniuses, let’s be serious) are being exploited by Paul Graham and company and tossed to these VC wolves who will eat many a carcass to get to the next Facebook (which MUST BE STOPPED… but I digress).

Seriously, in another Hollywood analogy, any start-up attempting to get their business going through Y Combinator is like the screenwriter in Los Angeles who will pay people to read their script because they “work at a studio.”

The chances of success in one of these cattle call models is virtually zero.

Zero for everyone except Paul Graham (and partners).

As a quick primer, allow me a paragraph (from Wikipedia) to explain Y Combinator to those who may not know what it is:

Y Combinator is an American seed-stage startup funding firm, started in 2005 by Paul Graham, Robert Morris, Trevor Blackwell, and Jessica Livingston. Y Combinator provides seed money, advice, and connections at 3-month programs. In exchange, they take an average of about 6% of the company’s equity.

Compared to other startup funds, Y Combinator provides very little money ($17,000 for startups with two founders and $20,000 for those of three or more). This reflects Graham’s theory that between free software, dynamic languages, the web, and Moore’s Law, the cost of founding a startup has greatly decreased.

In other words, throw a bunch of shit on the wall and see what sticks.

In other words, throw a bunch of shit on the wall and see what sticks.

Great for Paul Graham (based on his idea, Y Combinator would have gotten $20,000 from Y Combinator), but terrible for almost all of those thousands who apply to his program every year just in the hope of getting the YC stamp of approval (and 60 lbs of chili).

So Y Combinator is a Venture Capitalist that funds your start-up so that your start-up can get funded by another Venture Capitalist.

Enough with these f-ing VCs, man.

Whatever happened to creating a company, becoming successful and growing it based on that initial success?

Success because you have a product that people really (REALLY) want.

Thousands of techies are just sitting around coffee shops and cafes in all the “Silicon Valleys of the world” trying to think up new ideas that Paul Graham (and others like him) might like.

Not because it’s an idea that the start-up founder actually believes in anymore – but because it’s one that might get funding.

I mean, fuck passion, right?

These days it’s not whether your company succeeds or fails, it’s whether it gets funded in the first place and a mention on TechCrunch.

Jill Kennedy – OnMedea

Jill Kennedy – OnMedea

P.S. – Also Digg is dead – R.I.P. – so is Electus and Comic-Con… but I digress… again.

I totally agree with the blog. Though, I will not use such a blunt language against any one.

Taking small funding of a few thousand dollars from investors makes no sense. real entrepreneurs put their own money if they believe in it. If you need to go to raise external capital so early in the game then you are perhaps not ready to start a company.

Honestly speaking, two of my favorite companies in the mobile space are rapid tracker or rapid protect and mobipixie. Both are debt free, and have not raised any venture money. They will overtake every on in the area – it is just the matter of time. They have great execution team, a very clever management that clearly has their sight on big things to come.

Thanks for sharing the article

I commend you for not deleting this blog post even though it makes you look dumb in hindsight. Wish more people had this type of integrity.

I’m sure you’ve looked dumb in hindsight many times in your life as well. Maybe even more than me. I actually still agree with my post. Y Combinator is a stupid idea and in the long-term will prove to be a terrible decision for nearly all of the companies that get accepted and sign up. (And, yes, there are exceptions, of course. But they would have done just fine on their own without Paul Graham’s brilliant insight.)

lol: http://www.washingtontimes.com/news/2010/jul/23/manka-bros-take-media-by-storm-online-that-is/?page=all

You have made some valid points. Most YC combinator companies aren’t good company and most likely won’t even sustain. Most of the “founders” are young kids – that neither have money and not ability to take to the next stage at their own, YC provides them exposure, guidance and necessary, PR that can’t be obtained without “franchise” money.

I know two companies that have tried to remain independent of VC money – Rapid Protect, that produces Rapid Protect and Rapid Tracker mobile apps and cloud platform for family safety & collaboration and MobiPixie – which produces a mobile apps and platform for photo sharing and card design. Both started in 2011 or 12.

However, despite having better and more mature products, the media won’t cover them as they will cover a non-entity app developed by Y combinator boys. That is the power of PR. You need PR to get the success.

There’s all kinds of things wrong with this. I’ve heard decent criticisms of YC, but this is not one of them.

First, they’re seed accelerators, not venture capitalists. You’ve got them pegged in the wrong line of business. Yes, it it would be an outrageous amount they’re buying (and bad timing, and wrong in a dozen other ways), if they were VCs. They’re not.

Second, there’s plenty of data at this point to show that their success rate is way above the average for early-stage companies. Either they’re providing value, or they’re very good pickers.

Even if you thought that all the services provided by YC (including money to live on) were literally worthless, the selection process alone would make YC’s existence valuable. Many times and places where bright people from different disciplines were brought together yielded great insights, e.g., MIT’s Building 20. It sounds like the worst thing you can say about YC is that they are pulling some of the brightest people on the internet, paying them cash, and putting them in one room to talk about their ideas. (But apparently none of these smart, hardworking technical people realizes how much $20,000 or 6% is, as this is all just a trick to steal their money.)

Third, the entire premise of YC is that early-stage companies want an opportunity to give away less of the company for less money than venture capitalists. That is, there’s a market demand for it — else, why would anyone want to sell them their equity? Founders don’t want to have to wait and gamble on having a 7- or 8-figure company. You say that YC makes it all about getting funding, but on the contrary, this gives founders some money to live off of for a few months while they get started. It sounds like you think the entrepreneurs are simultaneously too smart for YC, and too dumb!

Likewise, you criticize YC as “throw shit against the wall and see what sticks”, but then turn around and say that those who succeeded would have succeeded without YC. If your claim is true (which seems unlikely, given the data), then they’re not doing any throwing. At worst, they’re identifying the stickiest shit as it’s in flight, and giving these people money and advice. You try to defend the entrepreneurs, but they’re the ones throwing shit (in your metaphor), and (so you claim) would be even without YC. I guess we need to protect the shit from itself? I’m not sure how that metaphor works at all.

Thanks for sharing the article, all ideas are reasons

This is what happened when you allowed a stupid blond girl to write. She barely knew what she was talking about. Hey , JK girl , what is 1+1 ?

What kind of scrubs are spending time trying to raise $30k? My company has made more than these startups and I’m 1 guys coding alone. What a bunch of f’n clowns!