5/12/14 UPDATE: AT&T to acquire DirecTV! Lock the doors – it’s scary out there.

2/12/14 UPDATE: Holy Crap, 2014 just got a whole lot uglier (and it was already hideous) with the announcement of Comcast acquiring Time Warner Cable!

ORIGINAL POST:

It’s coming.

Holy shit is it coming.

Millions are getting pummeled with a horrible winter but brace yourselves further, because you are in for a shitstorm of job cuts in 2014.

It will not be pretty.

It seems that media company CEOs are hell bent on proving to Wall Street that their companies can be growth companies.

Unless they fire every employee and start a new company by themselves in a garage, they cannot be growth companies the way Wall Street would like.

20% margins just will never happen again in the movie, TV, print, or music industries – so deal with it.

But these CEOs are guys (all guys) who think they can do anything.

But they will fail.

And then they’ll CUT.

And… it will not be pretty.

Tribune got things started.

My company’s CEO has called 2014 “The Year of the Hammer.”

No one will make it through unscathed.

First to go will be the packaged media folks. Those who support the production and distribution of DVDs and CDs and magazines, etc.

Gone.

Next will be the slow growth businesses – like movies and Broadcast TV production (serious like a heart attack).

Next will be the slow growth businesses – like movies and Broadcast TV production (serious like a heart attack).

Slates will be slashed, storytelling risk-taking will cease to exist.

Since no one can seem to do comedy anymore on Broadcast, they will be relegated to the epic mini-series format like “Under The Dome” and live Sports to stay afloat.

Then, finally, the low margin businesses will be hit – like console games. With the exception of a few huge titles, it’s a tough business and it certainly doesn’t help these overly-ambitious / delusional CEOs hit their targets.

So what’s going to be left? TV production for cable and Over-The-Top (OTT).

Why TV gets ownership of Internet content production is baffling to me. But they do.

By the end of 2014, giant media companies with their film studios, broadcast networks and massive real estate leases will be much MUCH leaner and the quality of the product will be much MUCH worse.

Hey, but a point of margin here and a point of margin there adds up to… 2 points.

But lighten up, Spring is coming.

Jill Kennedy – OnMedea

Jill Kennedy – OnMedea

OK – so the

OK – so the  And the same goes for Wall Street:

And the same goes for Wall Street: Jill Kennedy –

Jill Kennedy –

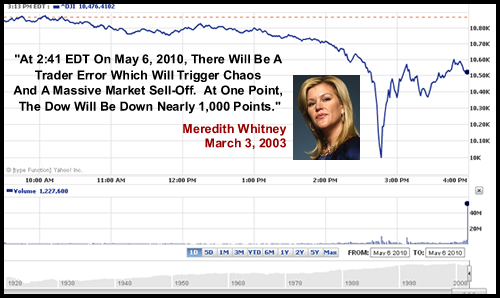

While today was an insane day on Wall Street with no one seeming to know anything about why there was so much volatility (Crisis in Greece, Banking Reform, etc.), there was one person who knew all along what would happen. If we would have just listened to her years ago, all of today’s anxiety could have been prevented.

While today was an insane day on Wall Street with no one seeming to know anything about why there was so much volatility (Crisis in Greece, Banking Reform, etc.), there was one person who knew all along what would happen. If we would have just listened to her years ago, all of today’s anxiety could have been prevented.

People really need to stop listening to this woman. I said it

People really need to stop listening to this woman. I said it  First of all, there is no chance this bill gets to the Congress before the mid-term elections in November and (thanks to the

First of all, there is no chance this bill gets to the Congress before the mid-term elections in November and (thanks to the